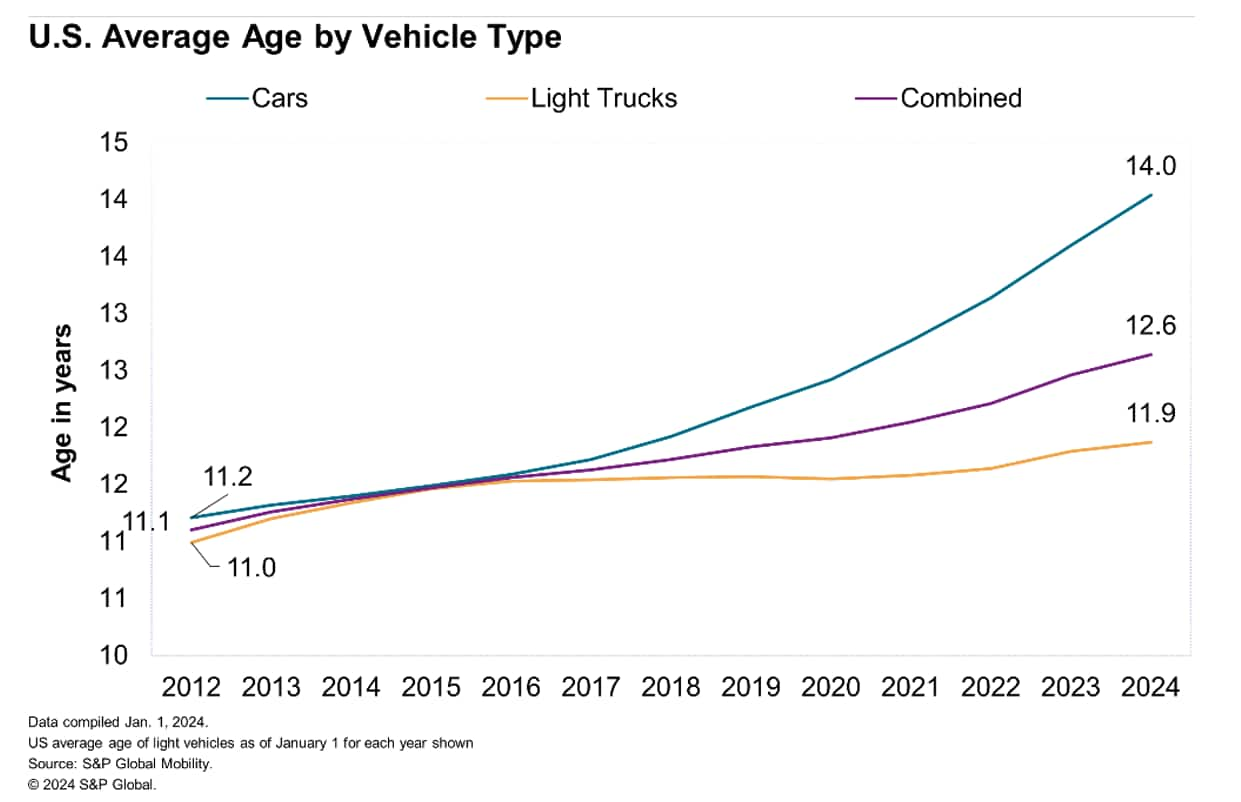

Cars, trucks, and SUVs in the United States keep getting older, hitting a record average age of 12.6 years in 2024.

This concerning trend is largely driven by consumers hanging onto their vehicles due to the prohibitively high prices of newer models.

According to a recent analysis by S&P Global Mobility, which tracks state vehicle registration data nationwide, the average vehicle age grew about two months from last year’s record.

While this may seem insignificant, it paints a grim picture of the financial strain many Americans face when it comes to purchasing a new car.

“It’s prohibitively high for a lot of households now,” said Todd Campau, aftermarket leader for S&P Global Mobility. “So I think consumers are being painted into the corner of having to keep the vehicle on the road longer.”

Rising Prices Keep Americans Holding On to Their Aging Cars

The affordability crisis in the automotive industry is undeniable.

With an average U.S. new-vehicle selling price of just over $45,000 last month, many households simply can’t afford to buy new – even though prices are down more than $2,000 from the peak in December of 2022, according to J.D. Power.

But it’s not just the sticker shock that’s keeping consumers from trading in their aging rides.

The pandemic-related shortages of parts, including computer chips, have also played a significant role in restricting the supply of new vehicles.

As a result, many potential buyers are forced to wait longer or settle for a used model.

Another factor contributing to the rising average age is the hesitancy surrounding electric vehicles (EVs).

With concerns over the charging network’s build-out and the technology’s maturation, some consumers are adopting a wait-and-see approach before committing to an EV.

By the Numbers: Dissecting the Aging Vehicle Population

The sheer scale of the aging vehicle population in the U.S. is staggering.

According to S&P Global Mobility, the U.S. vehicle fleet surged to 286 million vehicles in operation (VIO) in January, up 2 million over 2023.

However, the distribution of vehicles by age is changing.

Vehicles under the age of six accounted for 98 million vehicles in 2019, or about 35 percent of VIO.

Today, they represent less than 90 million vehicles and are not expected to reach that threshold again until 2028, when they will represent about 30% of VIO.

| Vehicle Age | 2019 | 2024 | 2028 (Projected) |

|---|---|---|---|

| Under 6 years | 98M (35% of VIO) | < 90M | ~90M (30% of VIO) |

On the other hand, the “sweet spot” for aftermarket services – vehicles aged 6-14 years – continues to grow.

With more than 110 million vehicles in that age range, reflecting nearly 38 percent of the fleet on the road, S&P Global Mobility expects this segment to rise to an estimated 40 percent through 2028.

“With average age growth, more vehicles are entering the prime range for aftermarket service, typically from 6 to 14 years of age,” said Todd Campau.

While the overall vehicle population is growing, the scrappage rate – the measure of vehicles exiting the active population – continues to hold steady at 4.6%, largely unchanged from 4.5% in January 2023.

However, there’s a notable shift in the mix of the fleet, with passenger cars declining faster than light trucks.

Shifting Consumer Preferences Reshape the Fleet

The rise of trucks and SUVs in the U.S. market is undeniable.

Since 2020, more than 27 million passenger cars have exited the U.S. vehicle population, while just over 13 million new passenger cars were registered.

In contrast, over 26 million light trucks (including utilities) were scrapped, but nearly 45 million were registered.

“Consumers have continued to demonstrate a preference for utility vehicles and manufacturers have adjusted their portfolio accordingly, which continues to reshape the composition of the fleet of vehicles in operation in the market,” said Campau.

This shift in consumer preferences has led to a noticeable difference in the average age of vehicles by type.

According to S&P Global Mobility, the average age for passenger cars in the U.S. is 12.8 years, while light trucks (including SUVs and pickups) have an average age of 11.9 years.

Automakers have been quick to respond to this trend, pivoting their production lines and marketing efforts to meet the growing demand for SUVs and trucks.

As a result, sedan sales have continued to wane, further accelerating the reshaping of the nation’s vehicle fleet.

Electric Age: EV Adoption Reaches 3.2 Million, But Lags Expectations

While the overall vehicle population is aging, the electric vehicle (EV) segment is still relatively young.

As of January, there were 3.2 million EVs in operation in the U.S., reflecting the growing popularity of this emerging technology.

In 2023, EV registrations surpassed 1 million units for the first time, increasing about 52% compared with 2022.

However, this rate of growth was slower than some automakers had anticipated, potentially impacting the average age of EVs in the short term as consumer adoption slows.

“We started to see headwinds in EV sales growth in late 2023, and though there will be some challenges on the road to EV adoption that could drive EV average age up, we still expect significant growth in share of electric vehicles in operation over the next decade,” said Campau.

Currently, the average age of EVs in the U.S. is 3.5 years and has been holding largely steady since 2019, with new registrations representing a large share of overall EV VIO.

However, if consumer uptake continues to lag behind expectations, the average age of EVs could rise in the coming years.

Aftermarket Opportunities Ahead as Fleet Ages

While the aging vehicle population may be a cause for concern for automakers, it presents a significant opportunity for the aftermarket and vehicle service sector in the U.S.

As vehicles age, the need for repairs and maintenance inevitably increases, creating a demand for parts, services, and skilled technicians.

With over 110 million vehicles in the “prime service window” of 6-14 years old, the aftermarket industry is poised for continued growth.

This segment represents nearly 38 percent of the fleet on the road and is expected to grow to an estimated 40 percent by 2028.

Consequently, companies in the aftermarket and vehicle service sector can expect to see an influx of business as consumers look to extend the lifespan of their aging vehicles rather than purchasing new ones.

This trend could pose challenges for automakers, as consumers may delay new purchases even further, impacting sales and revenue streams.

Outlook: When Will the Average Age Stabilize?

The rising average age of vehicles in the U.S. is concerning but this could eventually plateau once the supply of new vehicles normalizes and prices become more moderate.

However, the timeline for this stabilization remains uncertain, as high costs and economic uncertainty could extend the peak ages further.

One potential factor that could influence the average age is government policies and incentives.

If policymakers introduce measures to encourage new vehicle sales, such as tax credits or rebates, it could incentivize consumers to upgrade their aging vehicles sooner.

Conversely, stricter emission targets or regulations on older vehicles could also prompt a wave of replacements.

Additionally, as the economy stabilizes and household incomes improve, more consumers may feel financially secure enough to make the leap to a new vehicle.

However, if economic uncertainty persists or worsens, the trend of holding onto aging cars could continue for the foreseeable future.

“New vehicle sales in the U.S. are starting to return to pre-pandemic levels, with prices and interest rates the big influencing factors rather than illness and supply-chain problems,” said Campau.

He anticipates sales will reach approximately 16 million this year, an increase from 15.6 million last year and 13.9 million in 2022.

Conclusion

The rising average age of vehicles in the United States is a multi-faceted issue that reflects the complex interplay of economic factors, consumer preferences, and technological advancements.

While the record-breaking 12.6-year average age highlights the financial strain faced by many households, it also presents opportunities for the aftermarket and vehicle service sector.

As automakers grapple with shifting consumer demands and the transition towards electric vehicles, they must also contend with the reality that a significant portion of the nation’s vehicle fleet is well into its prime service years.

This could potentially impact new vehicle sales in the short term, but also underscores the importance of cultivating a robust aftermarket ecosystem to support the aging vehicles on our roads.

Ultimately, the path forward will likely involve a combination of policy initiatives, technological advancements, and a sustained economic recovery to alleviate the financial burdens that have contributed to the graying of America’s vehicle fleet.

Only then can we expect to see the average age stabilize and potentially decline as more consumers feel empowered to upgrade to newer, more efficient models.